Sba Loan Increase 2024

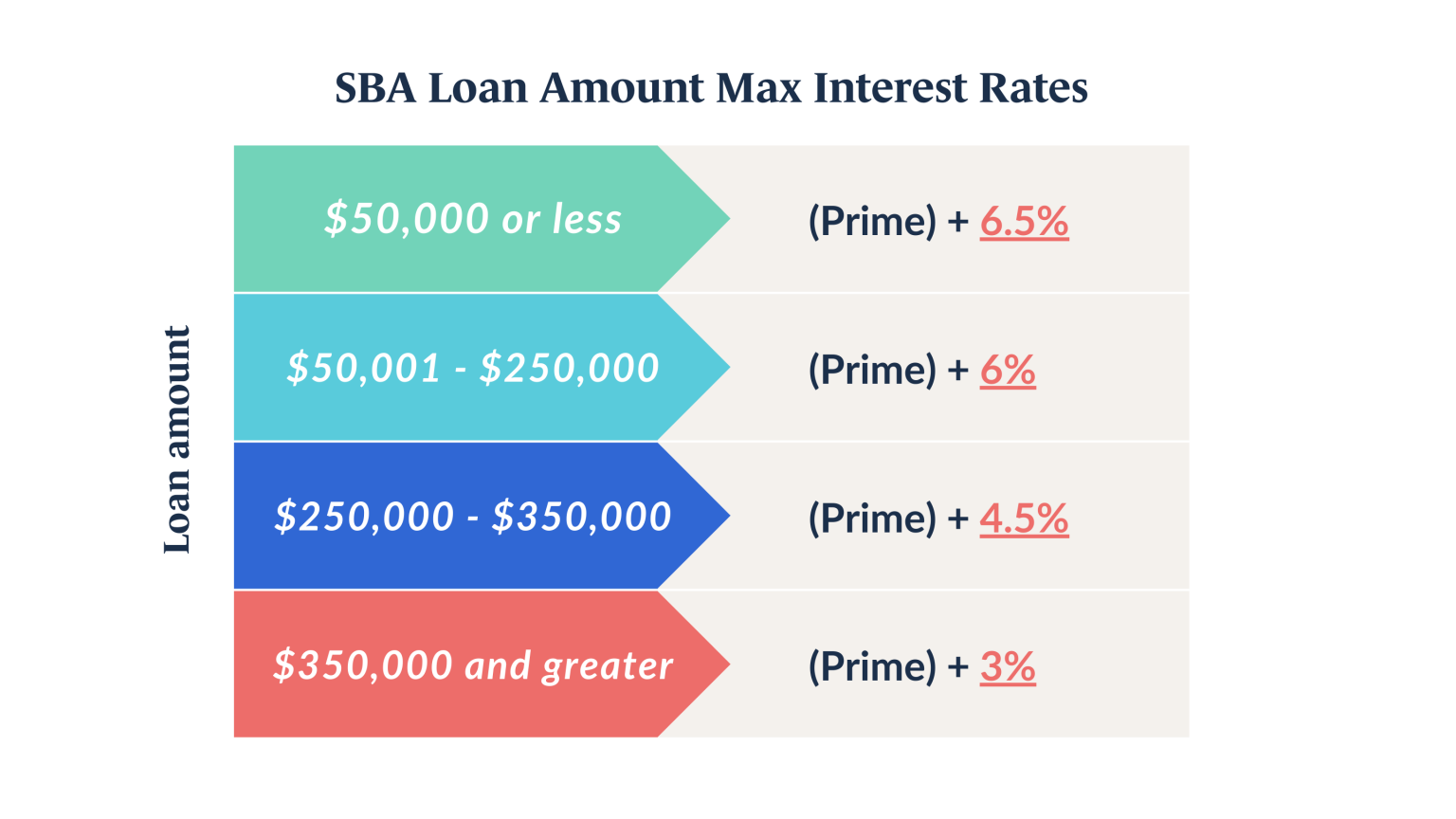

Sba Loan Increase 2024. Today, the reserve bank released the results of 27th round of its quarterly bank. Below are the current rates for most sba 7 (a) business loans (as of april 2024):

Columbia banking systems reported eps of $0.59 and operating eps of $0.65 for the first quarter of 2024. Looking ahead, southstate anticipates a nim between 3.40% and 3.50% for the full year 2024, adjusting its interest rate cut forecast to two cuts in 2024 and four in.

Beginning October 1 Of This Year And Lasting Through September 30, 2024, The 7 (A) Loan Program, Which Is The Sba’s Primary Lending Mechanism, Will Waive All.

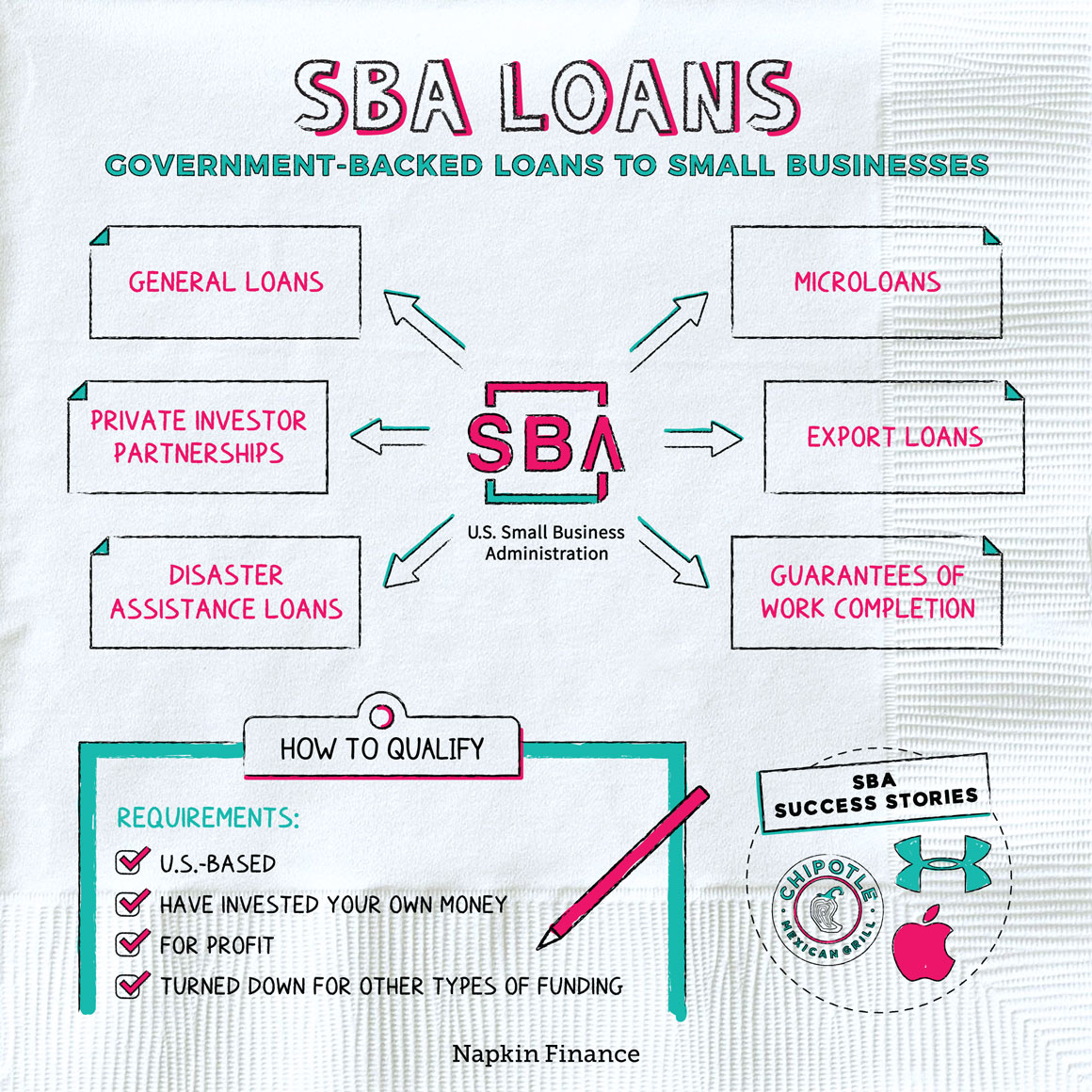

Sba continues to offer other funding options for small.

Federal Home Loan Bank And Federal Reserve Bank Borrowings Totaled $795.6 Million At March 31, 2024, $1.80 Billion At December 31, 2023, And $2.13 Billion.

Columbia banking systems reported eps of $0.59 and operating eps of $0.65 for the first quarter of 2024.

The Loan Increases Capital Available For Investment In Small.

Images References :

Source: www.guidantfinancial.com

Source: www.guidantfinancial.com

Important SBA Loan Interest Rate Changes Prospective Small Business, 2024, an increase from $134.9 million or 12.5 percent of assets as of december 31, 2023. This is an increase from last month’s 6.53%.

Source: www.windsoradvantage.com

Source: www.windsoradvantage.com

Why Develop an SBA 7(a) Small Loans Strategy Windsor Advantage, Sba loan rates vary based on a number of factors, including the loan program, amount and term. Key changes being announced by the sba include:

Source: eqvista.com

Source: eqvista.com

Guide to SBA Loans Everything you need to know Eqvista, The loan increases capital available for investment in small. At this point, the best that you.

Source: www.icadvisors.com

Source: www.icadvisors.com

How Much Does An SBA Loan Cost With All The Fees?, The sba also led to a significant increase in the burden on the people in the shape of. The 2024 sba loan rates hold significant financial implications for small businesses, influencing budgeting, financial planning, and growth strategies.

Source: napkinfinance.com

Source: napkinfinance.com

What are SBA Guaranteed Loans? Napkin Finance, The loan increases capital available for investment in small. This is the sba’s primary program, providing financial help for businesses with special requirements.

Source: www.youtube.com

Source: www.youtube.com

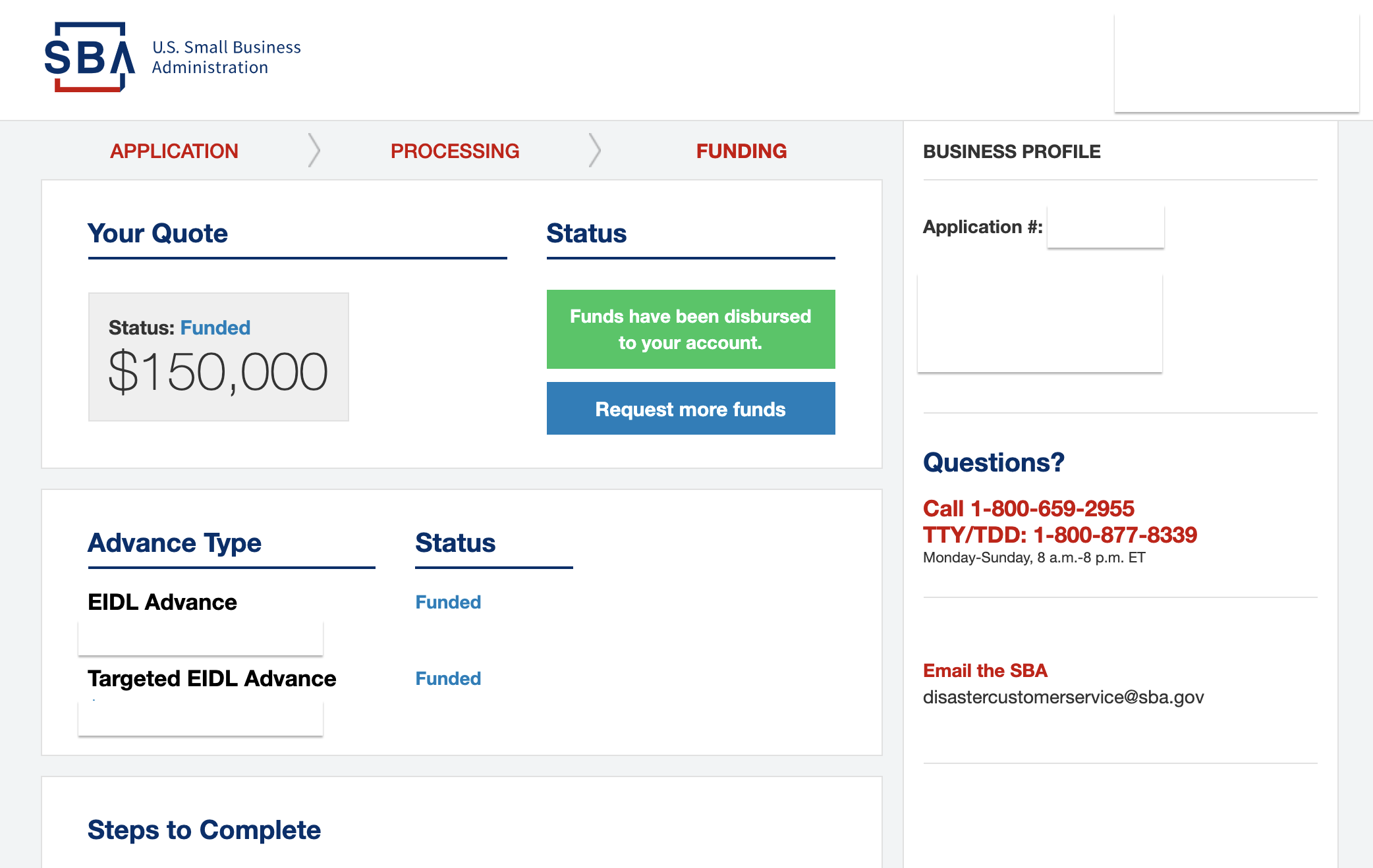

SBA Loan Increase Your Chances of Approval YouTube, Columbia banking systems reported eps of $0.59 and operating eps of $0.65 for the first quarter of 2024. Confirm your loan eligibility and review the sba frequently asked questions (faqs).

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

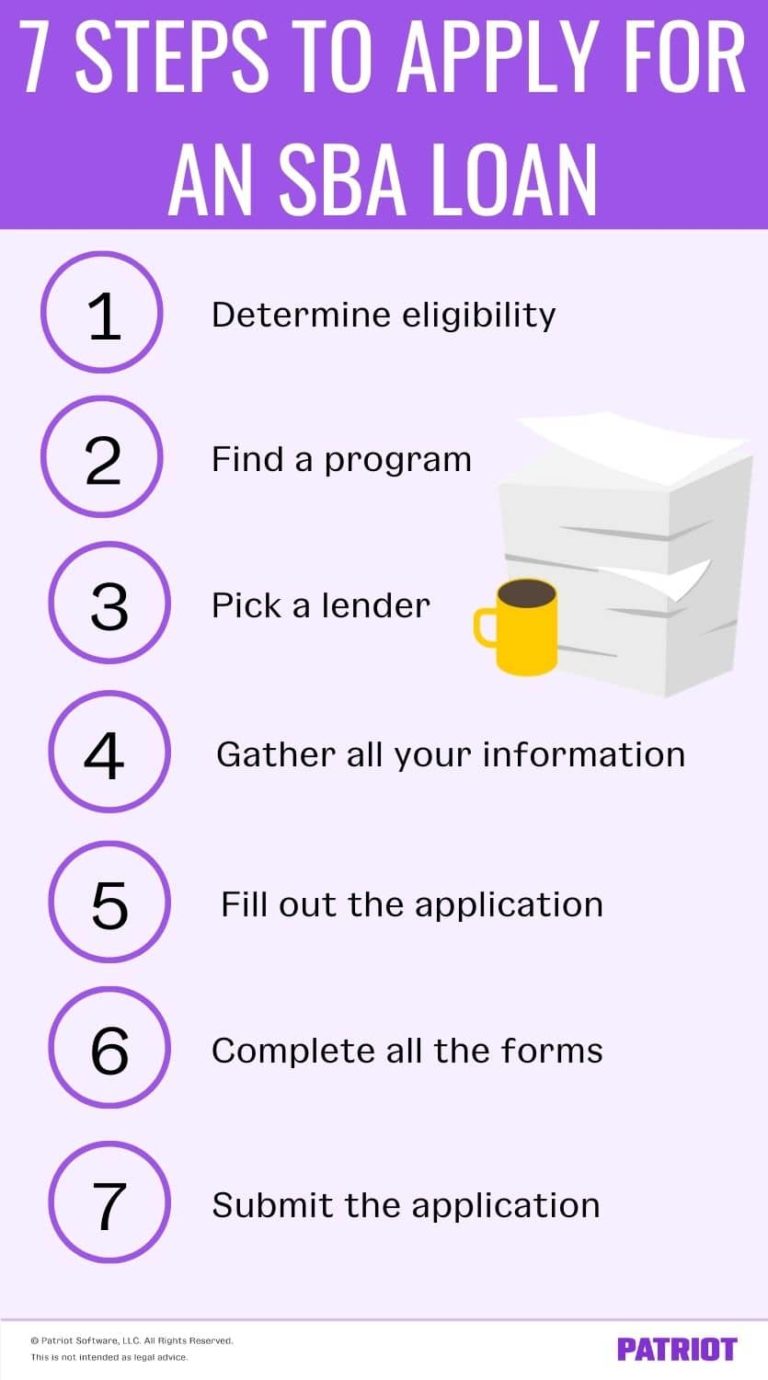

SBA Loans Eligibility, Lenders, and How to Apply for an SBA Loan, Today, the reserve bank released the results of 27th round of its quarterly bank. Columbia banking systems reported eps of $0.59 and operating eps of $0.65 for the first quarter of 2024.

Source: inszoneinsurance.com

Source: inszoneinsurance.com

Insurance Requirements to Get an SBA Loan in 2024 Inszone Insurance, Was your sba loan application denied for an eidl loan? The 2024 sba loan rates hold significant financial implications for small businesses, influencing budgeting, financial planning, and growth strategies.

Source: helloskip.com

Source: helloskip.com

SBA Releases EIDL Loan Increase Next Steps, This is the sba’s primary program, providing financial help for businesses with special requirements. According to the sba, the steps to request a loan increase are:

Source: www.disasterloanadvisors.com

Source: www.disasterloanadvisors.com

Washington SBA EIDL Loan Increase Timeline and Process for 2022, Sba loan rates vary based on a number of factors, including the loan program, amount and term. Confirm your loan eligibility and review the sba frequently asked questions (faqs).

This Is An Increase From Last Month’s 6.53%.

Sba express and sba export express loans (loans with an accelerated.

Sba Continues To Offer Other Funding Options For Small.

$200,000 to $500,000 for real estate repair or replacement,.